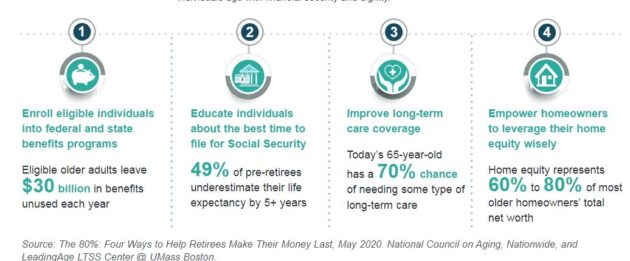

Eighty percent of U.S. households with older adults, or roughly 47 million households, are financially struggling today or are at risk of falling into economic insecurity as they more… NCOA: 47 Million Older Households Facing Financial Risks

NCOA: 47 Million Older Households Facing Financial Risks